Public Service Loan Forgiveness

1 out of every 10 Americans qualify for

Public Service Loan Forgiveness! Do you?

Congress created the Public Service Loan Forgiveness (PSLF) program in 2007 to encourage more graduates to take full-time public service jobs.

To qualify for the PSLF program, you must make 120 timely, qualifying monthly payments on your William D. Ford Federal Direct Loan Program (Direct Loan Program) loans while being employed full-time in an eligible public service job.

The following Direct Loan Program loans are eligible for forgiveness under the PSLF Program.

- Federal Direct Stafford/Ford Loans (Direct Subsidized Loans)

- Federal Direct Unsubsidized Stafford/Ford Loans (Direct Unsubsidized Loans)

- Federal Direct PLUS Loans (Direct PLUS Loans)—for parents and graduate, or professional students

- Federal Direct Consolidation Loans (Direct Consolidation Loans)

You may qualify for PSLF if you are employed full-time by a qualifying public service organization when paying each of the required 120 monthly loan payments or applying for loan forgiveness. You must also be working 30 hours per week annually to qualify for the program.

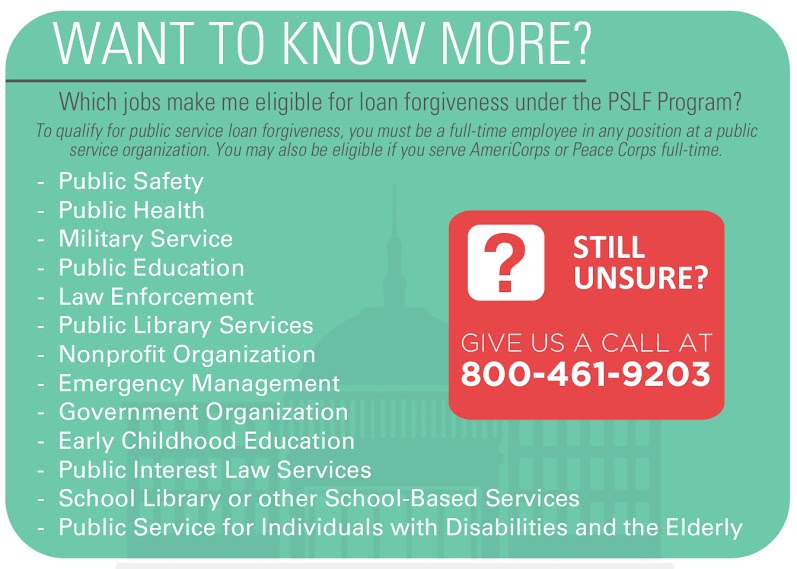

Give us a call at 800-461-9203 to find out if you’re eligible or click here to learn more about the PSLF Program on the Government’s website.

You must make 120 payments under any of these Direct Loan Program repayment plans:

- Income-Based Repayment (IBR) Plan*

- Pay As You Earn Plan*

- Income Contingent Repayment (ICR) Plan*

- 10-Year Standard Repayment Plan

- Any other Direct Loan Program repayment plan*

*Limitations may apply. See the Government’s website for more details.